Obama’s MyRA: What It Means To You

Important

Please be aware that, as stated in our last update, the MYRA program has been phased out. It no longer exists and you can no longer contribute savings to yours if you have one. It's important to know, however, that certainly all is not lost. You can transfer your funds into a ROTH IRA and withdraw money when you are eligible without paying taxes on those withdrawals. You can also get Roth IRA recommendations on myra.gov.

In his State of the Union address on January 26, 2014, President Obama announced a new retirement savings account for those without access to retirement plans from employers.

The plan would protect against loss of money you invest but it also has drawbacks, and its future is unclear.

Could the MyRA (pronounced not like the name “Myra”, but like I-R-A only My-R-A) help you save money for retirement and change your future?

In MyRA: The Basics below we help you understand what it is. Then we review the upside and the downside as well as what options you will have.

Understand that we assume the President has good intentions. But this plan is not a magic pill that is going to solve all your problems as you look ahead to retirement, no matter how far away that may be. And it will not have the power to narrow the income gap anytime soon.

MyRA will have some value if it gets people thinking about saving and working to better understand their options as well as about the value of consistently saving even small amounts. That’s what we'll start helping you do as we explain the MyRA. If that doesn't happen, then it could be just another polical play to appear to be helping lower income voters…

MyRA: The Basics

UPdate August 2019

As we have previously reported, the MyRA is no longer available. But some states, like California, are stepping up to provide retirement savings programs run by the government. The recently announced California program is called CalSavers. It’s intended to help close to eight million residents of the state who do not have access to an employee sponsored IRA or 401K. Companies will be able to sign up for the program in order to meet their legal requirement to offer retirement savings plans depending on the number of employees they have. Individuals with independent gigs like Lyft and Uber will also be able to join in as of September 1, 2019.

MyRA News June 2018

The MyRA has now been phased out. But that doesn't mean that you can't keep saving! In fact if you've gotten into the habit of regular saving then the MyRA, though short lived, has served a useful purpose. The MyRA was an IRA comparable to the Roth IRA. You can move your funds into a Roth IRA and enjoy building your savings for the future without paying taxes on the accumulated amount when you make withdrawals. You can still get some good advice about how to find and select your new IRA provider on the government website about the MyRA, myra.gov.

News Flash November 2017

The MyRA has had a bumpy road and the Department of the Treasury has announced that it will be phased out. Reasons given in the press release include the fact that sign ups have been extremely low, and the cost of the program since its start in 2014 has exceeded $70 million. After costs and benefits were assessed the conclusion was that the program was not cost effective — especially since there are other options that are not government run that provide safe investments as well as low or no fees. Existing myRAprograms are not accepting new enrollments any more but accounts already funded are still accessible. And you can continue to mange them. But no deposits will be accepted after December 4, 2017. End News Flash

The MyRA has the following characteristics (as presented by the President):

- government-run;

- Offers what Obama called “a decent return” (the rate earned by the fund available to federal employees);

- it will have “no risk of losing what you put in”;

- it will be deducted from after-tax pay;

- contributions not taxed when they are withdrawn;

- Obama is creating the plan by Executive Order – employers are not (yet) forced to offer it to employees.

The jury is out as to how widespread these accounts will be. Obama wants Congress to pass a law forcing employers with no savings plan to to provide their employees automatic-enrollment IRA’s. The MyRA could be one of those. So unless you specifically opted out, you would be automatically enrolled and money would be deducted from each paycheck and put into the account.

One of the main goals of the MyRA is to get more people comfortable with the practice (and benefits) of saving. To make things as easy as possible, the program allows you to fund your MyRA in three different ways. You can opt to fund it (1) directly from your paycheck (probably the surest way to be sure you save regularly and don’t forget and spend all your income…), (2) have funds transferred from your checking or savings account, or (3) fund it by having your federal tax refund sent directly to your MyRA account. All three are good ways to become disciplined about saving and more secure about your financial future.

It can be surprising for many to see how much even small monthly savings can add up to over time. The myRA.gov website includes super easy savings calculators to let yo see what different savings levels could mean to you over time. Just click on “savings calculators” then move the blue ball along the savings line from $1 to $50 saved per month. You’ll see, for example, that if you could save just $36 per month you’d have almost $2300 in your account in five years. And though you could earn a higher return elsewhere, these savings carry no risk — your return is guaranteed by the government.

July 2017 Update Have you opened a myRA? If so, congratulations on making an effort to save consistently for your retirement. If not, you may want to consider it or consider other options many find to be wiser investments. One alternative option is a Roth IRA. Many are free to open and the money you invest grows tax free. Best of all, when you are over the minimum age to withdraw from your Roth IRA, you take the money out tax free. That could be a major benefit. You can use a Roth to invest in the same things a myRA does — that is, in government bonds. But since those do not offer protection against inflation you might want to consider something like an Exchange Traded Fund. Some brokers (like Charles Schwab) offer ETF’s that do not have any commission fees.

March 2016 Update So what is the status of the myRA now that there’s a new administration in town (early 2017)? Although millions are eligible to take advantage of the savings plan, about 20,00 have actually signed up. Their assets total about $17 million. The account has no fees, and your capital is guaranteed not to go down. However, with that promise goes a very, very low rate of return and therefore growth in the account. Most of the people participating though are first-time savers, and now that the plan has been around for a while it is proven to work. And that’s a good thing. Now it appears that the plan may move to the state. which could also be a good thing. Stay tuned for more developments this year and see what this account could do for you.

April 2016 Update Do you have a tax refund coming this year? If so consider using all or part of it to bump up your retirement savings. The MyRA is a safe and pretty simple account that’s specifically for people without any employer-provided retirement savings plan. You can open one up easily at myRA.gov and start earning interest on your deposit right away. And you might be able to benefit from the “Saver’s Credit”. Depending on your income level you could get a tax credit of up to 50% for retirement contributions of up to $2000. And if you save at least $50 of your federal refund you can take part in the Save Your Refund Program. It’s a promotion that offers ten weekly prizes of $100 and a $25000 grand prize. You just save at least $50 from your refund and fill out a form to enter. You can learn more at saveyourrefund.com.

January 2016 Update In November of 2015 the MyRA was officially “unveiled. Since over 30% of those not yet retired have no savings for their older age, it is hoped it can help workers to start such savings. Since it has such a poor rate of return most financial advisors still steer people toward low cost Roth IRA's. However, they might appeal to the risk averse since your investments are guaranteed not to go down – and these are crazy times in the stock market.

August 2015 Update: The MyRA has been introduced with a minimum of fanfare and has certainly not created any buzz. To date it appears that no employers have signed up for the program, which is essential for it to be of benefit to anyone. Its limitations – that it caps at $15,000 and that you can only invest it in U.S. Treasury Bonds, thereby guaranteeing almost no return – are pretty hard to overcome. One writer in Forbes Magazine went so far as to call them a “wolf in sheep's clothing” since they may simply be a way for the president to unload the bonds the feds have been buying to shore up the economy. And money saved there can't be invested in higher growth opportunities such as the stock market. But stay tuned … and if your employer should offer a MyRA plan it could be a good way to start saving at least some money…

MyRA Pros and Cons

Pros

- You are guaranteed not to lose the money you invest.

- You can start out with an investment of just $25 and can have just $5 taken out of each paycheck. These minimums are much smaller than with traditional IRA plans.

- No administrative costs are charged to you (the government - i.e. taxpayers - pick this up so employers are not directly charged either).

- You can borrow from your invested amount without paying a penalty.

- The small investment requirements could be enough to get people to start saving at least a little bit each month.

- Once the account reaches $15,000 it will be rolled over into a Roth IRA and you would have more options in terms of how the money is invested and what returns you could achieve.

Cons

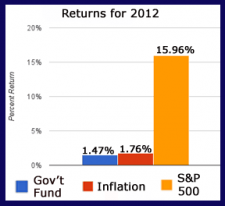

Though a return is guaranteed it has been comparatively low. The chart to the right shows sample returns for 2012 for the “G Fund” (which is the amount the MyRA would pay), inflation for the year, and the S&P 500-Stock Index Fund (a typical yardstick for comparisons.) At 1.47%, 1.76% and 15.96% respectively, the MyRA doesn’t shine. And some have questioned calling a rate that is less than inflation a “decent return”.

Though a return is guaranteed it has been comparatively low. The chart to the right shows sample returns for 2012 for the “G Fund” (which is the amount the MyRA would pay), inflation for the year, and the S&P 500-Stock Index Fund (a typical yardstick for comparisons.) At 1.47%, 1.76% and 15.96% respectively, the MyRA doesn’t shine. And some have questioned calling a rate that is less than inflation a “decent return”. - Since half of the target population for these accounts currently lives paycheck to paycheck, this return may not be enough of an incentive to save even a little bit.

- If employers are not forced to offer automatic enrollment, a very small percentage is expected to participate based on historical experience.

- The temptation to “raid” the account when a family’s money is tight could be hard to resist.

The account is not a cure-all but could be a first step getting people on an intentional savings plan. We would prefer that congress be asked to pass a bill giving incentives to businesses to participate rather than adding a new administrative burden on them. A “radical” proposal for this administration, which has shown itself to be anti-private sector, could be something that actually enhanced business prospects, increased earnings and wages paid to workers.

Consider opting in if your employer offers a MyRA - saving a little can make a big difference. Or see if you can't do better by putting regular, small amounts into a reliable, dividend-paying stock. Though gains would be taxable they still surpass the government account. Stay tuned for more details about how you can buy certain stocks with no transaction cost. If you want some ideas about how you might earn a little extra cash to be able to save, check out I Need Help.