FAFSA on Ed.gov

First, let's be very clear on one thing: you need to apply for FAFSA, and you need to do it even if you are 99% sure that you're not going to qualify for financial aid. You could be very wrong! A lot of pretty well to do people still qualify for aid because there are so many factors that go into the formula that determines your need. So go ahead and do it – they've made it easier to fill out and it could make a huge difference in your finances. Remember that you don't have to wait 'til January any more to fill it out, so be ready to go as soon as October rolls around. And if parents or grandparents have put money into 529 accounts be sure to check with a financial advisor to do it in a way that minimizes the amount by which it might reduce the amount of aid you can get.

The Free Application for Federal Student Aid (FAFSA) connects students with government money to help pay for education. Government assistance occurs primarily in two forms: scholarships and loans. Often these loans are provided at cheaper rates than what is offered by banks.

As a service of the Department of Education, the FAFSA champions the promise of postsecondary education to all Americans. Your education is of positive value to society. $150 billion dollars is awarded each year to get people educated!

The Department of Education provides two other websites related to the FAFSA. The first website, previously college.gov provides encouragement and checklists for all young adults considering college. We couldn't agree more about the value of a college education. Continued learning is often a key to success. Not only does it provide opportunities to increase your skills but also to meet new people. Growing your social network in college increases your value in the world.

Another section of the student aid website is directly related to the FAFSA goal of providing financial assistance to students: Studentaid.ed.gov. The majority of information here will lead you back to the FAFSA but if you're looking for tools to estimate FAFSA financial aid or loan repayment plans, then this is useful.

Getting Personal

All these websites are specifically for education beyond high school. If you're looking for assistance in high school and you attend a public school, seek out help from the Principle or Superintendent of the school or district.

New Forecasting Tool: April 2019 Did you know that there’s now a way to get an early peek on your federal student aid eligibility, before you fill out the whole fafsa? Sounds very cool, especially if you’re tempted not to bother applying at all because you are assuming you won’t qualify for aid. This could change your mind very quickly by showing you potential results early. Then you don’t have to be one of the thousands of folks who are actually leaving money on the table either because they don’t fill out the fafsa or because they file so late they miss out on available funds. You can even use this new tool (called FAFSA4caster) while you’re a high school junior or even as a middle schooler. Adults can use it too! Remember, this isn’t an application for assistance, it is more of a forecasting tool to help you plan. Learn more by searching for FAFSA4caster.

Update February 2018 Are you one of those people that tends not to take deadlines very seriously? Don’t make that mistake with the FAFSA! If you miss a deadline you really (really!) miss out — and you really don’t want to leave money on the table! You must pay extra attention to deadlines when it comes to the FAFSA because there is not just one deadline to keep track of. There are federal deadlines, state deadlines, and even sometimes specific deadlines for specific colleges. The official fafsa website makes it easy to identify the deadlines you need to care about. Right on the home page, below the big box, just click on the “Deadlines” link. It will take you to a page where you enter your state and your school year you’re applying for and it will show you relevant deadlines.

Update September 2017 For this past year families were able to fill out their applications in October 2016 rather than having to wait for the beginning of 2017. And they reported tax data from an earlier year than before, in this case from 2015. The same will be true for the 2017-2018 academic year! So you’ve already done most of the work as they will again be using data fro 2015. And you still get to complete your application in October. And that’s a very wise thing to do even though you might tend to procrastinate. The earlier you get your information complete and submitted, the greater potential for your awards.

Update January 2017 An interesting option on this site’s homepage is the Featured tab in the Featured section called “Find Schools.” Clicking on that tab takes you to a page where you can see lists of schools according to the programs and degrees offered, the location, size, name and other advanced options. They also provide some interesting data tidbits to offer some encouragement. One is that college graduates as an average have been shown to earn a whopping $1 million more than high school graduates over their entire lifetime. That should provide some motivation … Also, if you qualify for a Pell Grant you could get close to $6000 in a grant that never needs to be paid back. And, in case you’re feeling like you’re too old to be going to college, they report that almost a third of college students actually started at 25 years of age or older. So don’t get discouraged! It’s worth to the effort to learn all you can and go for it!

Udate October 2016 ed.gov is a good, reliable site to get your information about the FAFSA and other forms of government financial assistance for college. One of its most useful features is the highlighted sectioin on the right with the header “How Do I Find…?”. Choose from one of the popular topics listed and you’ll go right to more information. It’s updated regularly too. And the good news right now is that the 2017-2018 is now ready for you to fill out and submit, so hurry and do that before some colleges, schools and states run out of funds! The other good news is that the IRS information retrieval system is also now available. If you filled out a FAFSA last year you will use the same tax data (the year 2015) again for the 2017-2018 application. So take advantage of it now and get your application in ahead of the crowd!

News: Pell Grants for High School Students The Department of Education has announced that for the 2016-2017 school year, Pell Grants will be available for high school students who take college courses while they are in high school. They expect to award as much as $20 million to assist about 10,000 students. This could go a long way toward reducing your college costs and helping you to graduate in fewer years. Learn more at Qualify for a Pell Grant.

Just about all this is for citizens. However, some people can get aid based on their visa status and types. Trying to understand immigration law is like the tax code: really complicated. If you're in this category, it's best to use live help: online or at 1-800-433-3243.

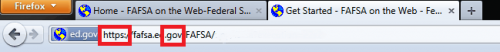

Using this government website requires login. It's a little scary because they want your social security number. In general, never enter this information into any website. There are two reasons you can trust the FAFSA. Both reasons are highlighted above in red rectangles.

The first highlight shows the site URL prefixed with “https”. The interent uses HTTP for communication and the version with an “s” appended is the secure version. Financial information should always be safeguarded with HTTPS for communication. You can see for yourself if you bank online. Visit your banking website and when you got to login, you'll notice an “https” prefix in your URL. If you don't see this, contact your bank immediately.

The second highlight shows the site's domain suffixed with ”.gov”. The interent uses this domain suffix to classify U.S. Government related websites. As much as you already trust the government with your personal information, you can trust this website.

More on the Process

After you login, click start, create a password to save your form, and follow the directions. It's all pretty intuitive. Remember that this process is free and intended for High School seniors or those planning to attend college in the upcoming year. You'll see five sections to fill out: Student Demographics, School Selection, Dependency Status, Parent Demogrpahics, and Financial Information.

Nope, you don't just “get money for free”. You need to fit a set of criteria and you probably can't change to meet that criteria. You either fit or don't. They don't hand out money to rich kids, working adults, or poor kids with rich parents. However, don't make assumptions about what is considered “rich”. A surprising number of families with incomes over $100,000 do qualify for some type of aid. Be aware that not all schools are treated the same. If you're looking to go to Harvard which costs a ton, don't expect the government to pay for it all. But you should check our article about finding scholarships to see if you can get some money there.

With regard to the amount of information required on the application, there is some good news for 2016. Parents will be able to use their tax returns from the year before last, so they don't have to try to get their current tax return in super early for you to qualify for aid. And there is a way the information can be automatically input to your application so there's not a lot of tedious hunting for the right information. You can learn more about this and more important timing issues in our review of the FAFSA.

The hard part is not getting scammed. You can trust FAFSA because it's backed by the U.S. Government. Don't trust any other places promising “free” assistance. They're usually ripoffs. Remember, if it sounds too good to be true, then it probably is!

You'll probably see stuff about Title IV and Stafford loans. This has to do with the school and your financial situation. You can't go to a fake school and get money for it. Everyone tries to make a cheap buck on students so beware of scams and don't fall for them. The best way to combat scams are to talk to people. There's a lot of help in communities at libraries, school counselors (High School, Community College, Vocation School, etc.), and religious or ethnic community organizations and foundations.

As you receive your information about what Pell Grants you might get and what loans may be offered to you, be careful not to get in over your head. If you're going to take on a lot of loan debt - that's money that will have to be paid back - be sure that you are taking classes in truly useful topics that will mean something to employers. That is, you'll be able to get a job and you'll be able to start paying back your loans when you need to. If this advice is already too late and you're having trouble repaying your loans, check out grants to pay off student debt.

If you found this article useful, you may also want to discuss and learn about other websites on the internet.